Normally, when you sell property held for investment or business purposes for a greater value than that which you originally paid for it, any gain you realize from the sale will be subject to capital-gains tax. However, a Section 1031 exchange—also called a tax-deferred exchange— allows you to sell property and acquire replacement property through an exchange method, allowing you to defer having to pay capital-gains taxes resulting from the initial sale. This allows you to, in effect, reinvest the sale proceeds without having to pay additional taxes and can therefore be a powerful money-saving tool if used correctly. So, for example, if you own a rental property (say, an apartment) that you wish to sell because you'd like to purchase similar property in a different location (say, because you are moving or because you'd like to take advantage of a favorable housing market), a 1031 exchange can help you do that while deferring capital-gains tax.

Part 1 - Conducting a 1031 Exchange

Part 1 - Conducting a 1031 Exchange

1.) Consider hiring professionals to assist you. In order to conduct a 1031 exchange—and safely navigate the complexities of the relevant provisions of the Internal Revenue Code—you should either (1) have a sophisticated understanding of the portions of the United States Code governing 1031 tax-deferred exchanges or (2) find a qualified professional to assist you. Because tax laws change and new tax regulations are issued periodically, your best bet for a successful 1031 exchange is to enlist the help of a professional.

- An attorney, tax specialist, or accountant will not only help you understand exactly what you need to do in order to conduct a valid 1031 exchange but can also ensure that you don't make any mistakes during the process.

- A real estate agent will also be helpful—especially if they have been a part of a 1031 exchange before—and should know what language to insert in the relevant contracts to make the exchange go as smooth as possible.

- As soon as you decide to conduct a 1031 exchange, be sure to tell any professionals you will be working with during the exchange (i.e., your attorney, your real estate agent, etc.) of your intent so they can properly assist you in conducting the transaction.

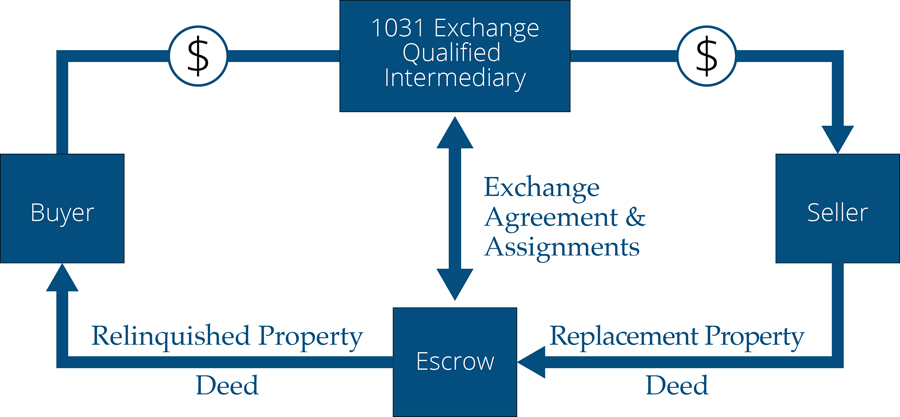

2.) Find a buyer for the property you wish to sell. This property—commonly referred to as the "relinquished property," because this is the property you will be giving up in exchange for another—is the property you will be exchanging for another in this transaction in order to defer capital-gains taxes. Your next step, then, is to find someone who is willing to purchase your property at the amount at which you wish to sell it.

- Once you have found someone willing to purchase your relinquished property, you will enter into a Purchase & Sale Agreement with the buyer.

- This clause in the agreement should read something like: "Buyer understands it is Seller's intention to use this transaction as part of a 1031 Exchange, and hereby agrees to cooperate with Seller to accomplish same."

- This is important because the Buyer will have to sign certain exchange documents in order for you to successfully complete your 1031 exchange.

- Generally, you will use either a bank or a law firm as your Qualified Intermediary.

- The reason for this is that, to receive the tax-deferment benefits of a 1031 exchange, you must not have direct control over the funds from the sale of your relinquished property, otherwise the IRS will treat this as a sale and subsequent purchase—not a 1031 exchange.

- This agreement should provide that you will be assigning seller's rights for the relinquished property and buyer's rights for the replacement property to your intermediary, so it can act on your behalf without you ever directly controlling the funds involved in the exchange.

- You must enter into this agreement with a Qualified Intermediary before the closing date for the sale of the relinquished property.

- You may identify up to three potential replacement properties regardless of their value. If you wish to acquire more than three replacement properties, you may identify more than three potential replacement properties so long as the total fair market value of your identified properties does not exceed 200% of the sale price of your relinquished property.

- This replacement property/properties should have a fair market value greater than or equal to your relinquished property in order for the exchange to be completely tax-deferred.

- If the replacement property is real property, you must provide the street address and name of the property in your written identification.

- You have 45 days from the sale of your relinquished property in which to select and identify replacement property.

- This Purchase & Sale Agreement should include specific 1031 language, similar to the Purchase & Sale Agreement for your relinquished property.

- You must complete the exchange and receive title to your replacement property within 180 days of the sale of your relinquished property or the due date of the income-tax return for the year in which such property was sold—whichever date is earlier.

- This form is available online via the IRS' website.

- Tax law is quite complex, and the best way to find out if your state has a 1031 reporting requirement is to consult with an experienced tax attorney.

- You can also try searching for this information online using the phrase "<<your state>> 1031 reporting" and looking over the results to see if any state websites provide forms for state-reporting purposes.

Part 2 - Avoiding Problems with your 1031 Exchange

- Unused land in exchange for rental property.

- A single-family rental property in exchange for a multi-family rental property.

- Retail space in exchange for a hotel.

- A farm/ranch in exchange for a golf course.

- Take note that real property located within the United States is never like-kind to real property located outside of the United States.

- If you are unsure as to whether the properties being exchanged are like-kind—or, for that matter, if you have questions about this or any of the following requirements, consider the benefits of paying a (relatively) small amount of money for the advice of a professional instead of finding out later that your exchange was invalid and that any associated gains are fully taxable.

- If you are contemplating a 1031 exchange that involves personal property, be sure to seek the advice of a qualified tax attorney or accountant regarding whether the property you are planning to exchange satisfies the like-kind requirement.

- Inventory or stock in trade (i.e., property held primarily for sale).

- Stocks, bonds, or notes.

- Other securities or debt.

- Partnership interests.

- Certificates of trust.

- Remember, you have 45 days from the date you close on the sale of your relinquished property to identify potential replacement property/properties and generally must complete the exchange within 180 days of that date.

- These timeframes include business days, holidays, and weekends.

*Source wikihow.com & Solid Rock Property